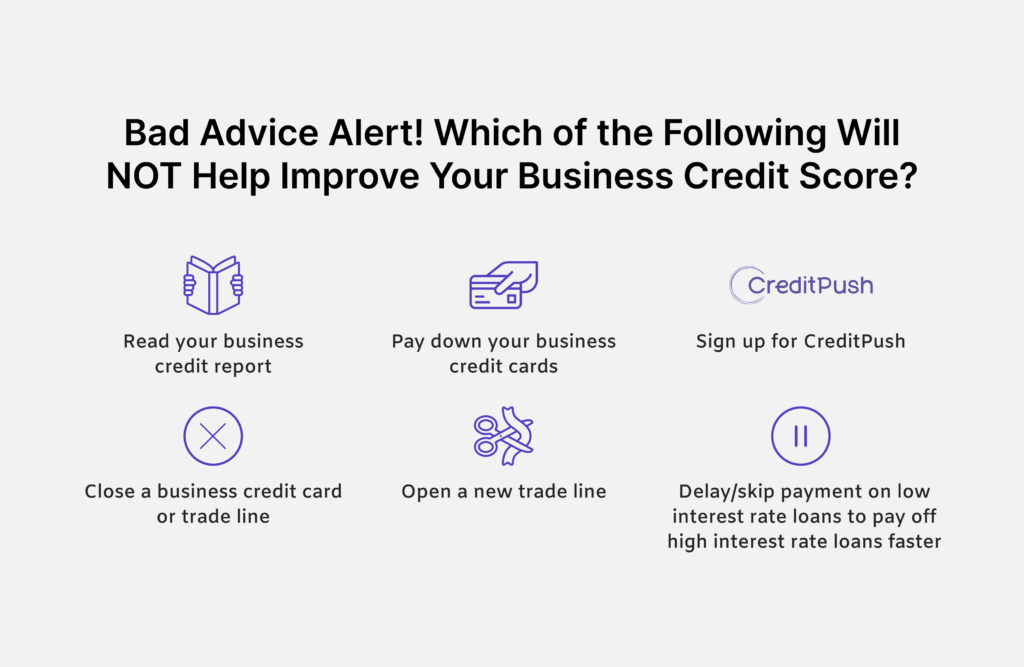

Bad Advice Alert! Which of the Following Will NOT Help Improve Your Business Credit Score?

Here’s a hint – two of these are bad advice. Have you identified which ones? Read on to check if you were right!

Read your business credit report.

This is GOOD advice! Why would you want to read your business credit report? Well, there are three solid reasons to do so. The first reason is to identify any problems that may need to be remedied. What you don’t know about can definitely hurt your business. The second reason is that there may be mistakes that you will need to report to the credit bureaus. Those mistakes can hurt your business credit score, so it pays to fix them. Finally, you will want to read your business credit report for signs of fraud. Scary but very important.

Pay down your business credit cards.

This is GOOD advice. While having access to more credit helps your business credit score, using too much of that credit can hurt your business credit score. Paying down your business credit cards can make a big difference to your business credit score, in particular, if you have used more than a third of your credit limit.

Close a business credit card or trade line.

This is BAD advice. While it is good to pay down your business credit cards or trade lines, it may not be a good idea to close them completely. Having a history of long credit access in your credit report is a positive, and closing this access can take this history off of your credit report. Furthermore, it decreases the amount of available credit that your business has access to, which will also negatively impact your business credit score. It may be better to keep the credit card or trade line open, but simply not use it.

Make sure that there are no annual fees if you are using this strategy – otherwise, you may decide to close the account anyway.

Open a new trade line or business credit card

This is GOOD advice, as long as you do not spend too much of the new credit, and do not spend money that you would not otherwise have spent. Of course, you also need to make sure to make all payments on time. Opening a new trade line or business credit card is helpful because it increases the amount of credit access that you have, which is a positive when it comes to your business credit score. Also, having enough credit lines is important for building a robust credit history. Having less than three credit lines may count against your business.

Sign up for CreditPush

This is EXCELLENT advice. CreditPush can get you a free business credit report, and also help you identify ways to improve your business credit score. CreditPush can even boost your business credit score for you if you provide access to the apps that you use for your business.

CreditPush is able to do this because it has agreements with credit bureaus to consider your business’s proprietary data for potential increases in your business credit score. Doing this does not negatively impact your business credit score. This can be especially advantageous if your business has a limited credit history, as your business data could give them enough information about your business to justify a higher score!

Delay or skip a payment on low-interest-rate loans to pay off high-interest-rate loans faster

This is BAD advice. Always pay at least all minimum payments on time, as otherwise, the non-payments will hurt your business credit score – and likely cost you interest and late fees! However, it often makes sense to pay only the minimum amount on low-interest-rate loans if it allows you to make higher payments on high-interest-rate loans.